A better-than-expected jobs report on Friday demonstrated the enduring strength of the US economy, despite years of high interest rates and relentless inflation.

Employers hired 272,000 workers this month, above economist projections of 190,000 new positions, according to statistics from the United States Bureau of Labor Statistics. The unemployment rate increased to 4%, the highest it has been since January 2022.

The hiring rate topped the previous year’s average number of jobs added every month, and it increased significantly from the 175,000 positions added in April.

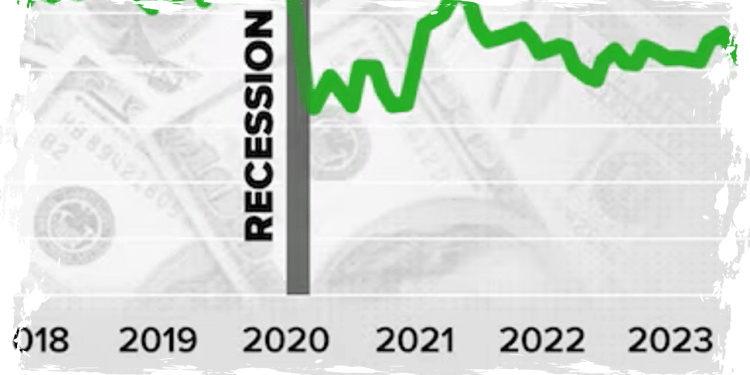

The stunning report defies the country’s slowing economic development. Gross domestic product slowed sharply at the start of this year, implying that the extended high interest rate policy had hampered company investment and economic growth.

“The May jobs report was strong across the board,” Bret Kenwell, an eToro investment analyst, said in a statement to ABC News.

In theory, high interest rates reduce consumer demand and delay inflation. Inflation has declined dramatically from a high of 9.1%, but it is still more than a percentage point above the Fed’s goal rate of 2%.

A drop in job openings published earlier this week appeared to reflect the economic slowdown. Job vacancies declined in April to their lowest level since February 2021, according to BLS data released Tuesday.

However, the job market startled analysts on Friday with a surge in hiring, which enhances the economic outlook but may complicate the Fed’s decision next week on a likely interest rate cut.

If the Fed decreases interest rates too rapidly, inflation may rise again because higher consumer demand combined with strong economic activity could accelerate price increases.

Average hourly wages increased by 4.1% in the year ended in May, according to new data released on Friday. That rate of salary increase exceeds inflation, demonstrating that workers’ purchasing power has increased even as prices rise.

The report is good news for workers, but it may cause policymakers to pause because they are concerned that a pay increase may drive businesses to hike prices to meet the additional personnel costs.

“Today’s data undermines the message that other recent economic data have been giving of a cooling U.S. economy and slams the door shut on a July rate cut,” Seema Shah, chief global strategist at Principal Asset Management, said in a statement to ABC News.

Following the jobs announcement, the major stock indices sank modestly in pre-market trade.